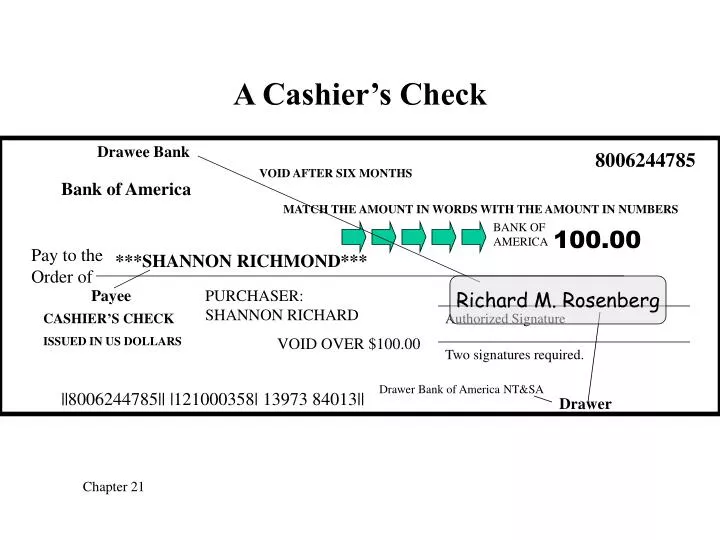

If it sounds illegal thats because it is. Unlike personal checks cashiers checks pull from your account when the bank issues the check.

Frequently Asked Questions About Cashier S Checks Mybanktracker

Most banks issue cashiers checks.

Can you make a cashier's check out to yourself. If you want the funds to go to someone else either deposit the cashiers check to an account and write your own draft to the other person or return the item to the institution that issued the check. You can get a cashiers check payable to yourself yes. You will still be asked to bring your personal checkbook in the event that any last minute changes are necessary but the best way to make sure that the closing goes smoothly is to bring that cashiers check made payable to yourself.

You cant get a blank cashiers check without the payment amount or payee filled in so you must know your payees name and the specific payment amount to get one printed by your bank. One difference though is that you can usually get a cashiers check from almost any credit union whether or not youre a member. In my experience usually having your bank make out the check to yourself makes the most sense.

You cant print cashiers checks yourself at home. Since a personal check can take several days or longer to clear certified funds in the form of a cashiers check are required so that the closing is not delayed. Keep in mind that if the account is a joint or business account everyone involved must sign it to deposit it.

You may be able to get free cashiers checks if you have a premium checking savings or money market account at the bank. Mailing address to receive it. You can also take a check from your checking account write it out to yourself and deposit it into your savings account.

The process of getting a cashiers check at a credit union is similar. Cashiers checks are issued to one payee and are recorded as such at the time theyre issued. So if you dont have a bank account you should call before going to any bank to make sure they will issue you a cashiers check.

2 Talk to a teller. Generally banks are required by law to make the money from official bank checks including cashiers and certified checks available to you within one business day after you deposit it to your. Some banks offer free cashiers checks in certain circumstances.

A cashiers check has the payee information completed on the check itself. You then sign the check over to the title company. It may be useful to take the payee to the bank with you so that you have all the information you.

For example you can get a Wells Fargo cashiers check for a 10 fee but you must pay an additional 8 delivery charge if you order the cashiers check online. Postage or delivery fees might then apply. Unlike a money order on a cashiers check you cant write in the payee information yourself.

At most banks any teller can fill out a cashiers check for you. If the amount of the Check exceeds 10000 there might be IRS reporting. You get it from a bank teller and you pay the bank the amount of the check and the fee.

When you request a cashiers check to pay a business or person the bank first checks your account to make sure you have the amount you need to. You wont be able to request a cashiers check over the phone or online. Your bank or credit union may also offer cashiers checks online.

Usually you have to have an account at the bank. And you need the name of the payee the business or person you are. They will make it payable to whomever you want them to.

If you request a cashiers check online youll need a US. If you cant make it into a bank branch you may be able to have a cashiers check sent to you. Cashiers checks are drawn on a financial institutions funds but you supply the check amount to your bank ahead of time.

You can legally write a check made out to yourself and cash it. As a result you cant get a cashiers check unless you actually have sufficient funds in the account or you bring cash to the bank.

We Accept Cashier Checks Money Template Cashier S Check Payroll Checks

Cashier S Check Vs Money Order What S The Difference Bankrate

Useful Info To Know When Gathering The Down Payment Cash For Closing Cashier S Checks Are Regarded As One Of The Safest Cashiers Closing Costs Cashier S Check

Cashier S Check Vs Money Order What S The Difference Bankrate

Ppt A Cashier S Check Powerpoint Presentation Free Download Id 5848234

Cashiers Checks Are Guaranteed By A Bank Drawn On The Bank S Own Funds And Signed By A Cashier Business Checks Payroll Template Payroll Checks

Cashier S Check Examples Examples Of Cashier S Check Examples10 Com Cashier S Check Money Template Payroll Checks

Cashier S Check Scam Avoid Cashier S Check Cashier S Check Bouncing

Personal Finance 101 What Is A Cashier S Check The Simple Dollar Personal Finance Cashier S Check Finance

0 Komentar